In this third part of the series, our focus turns to the controversial Marijuana Delivery Operator, the licensee that will receive and fulfill consumer orders, and not the courier model, which acts essentially as an UberEats for brick and mortar retail stores.

Today we dispel many rumors and speculation, focusing on how the home-delivery model works with a Q&A feature.

The Marijuana Delivery Operator license allows the licensee to purchase products at wholesale, accept and fulfill online orders, and deliver those orders directly to the consumer’s residence as listed on their valid government-issued identification. Unlike California’s “ice cream truck” model, which allows vans to roam freely and respond on the fly when a consumer places an order, in Massachusetts consumers must pre-order and each order is packed just for that customer. Delivery vehicles must not carry extra inventory.

Common Misconceptions about the Marijuana Delivery Operator

1—Are Marijuana Delivery Operators a form of a Retailer License?

No. Rumors presently abound that home-delivery operators are retailers. Many of the existing retailers, backed by the Commonwealth Dispensary Association (CDA), have argued that Home Delivery Operators, by virtue of the fact this license class can purchase products at wholesale, accept online orders, and deliver direct to consumers, is actually a form of retail license. The Commission has clarified that “Marijuana Delivery Operators are not considered Marijuana Retailers under the Commission’s regulations,” though even so “they must register as a vendor with the Department of Revenue (DOR) and collect and remit marijuana retail taxes in accordance with DOR regulations.”

2—Are marijuana Ban communities allowed to host a marijuana delivery business?

A delivery operator is not a retailer, and therefore in communities that have banned retail marijuana stores a delivery operator Home Community Agreement (HCA) can be granted, if the municipal government sees fit.

3—May municipalities that have awarded their limit of retail HCAs host a delivery business?

A delivery operator is not a retailer and therefore has no impact on the existing total of retail HCAs, and in communities with no additional retail HCAs left to grant, a delivery operator HCA can in fact be awarded.

4—If a ban community sites a home delivery operation, is that a waiver of their retail store ban?

No, these are two distinct classes of license. Siting a home delivery business is not the same as siting a retail operation.

5—Home delivery of marijuana is not permitted in municipalities that have a Retail Store Ban. If such a community sites a home delivery operator, does that mean home deliveries are allowed in that community?

Yes. While siting a home delivery operator will have no impact upon a Retail Store ban, it will allow home delivery of marijuana products in a vehicle that meets the current regulations standards, including: unmarked delivery vehicles with two staff, with the delivery agent who must wear a body camera. Delivery and security requirements will be reviewed in greater detail in the next part of our series.

6—Where can a home delivery operator drop off product? If a 21 year old student can order, they could be stocking up for their entire dormitory? What if a group of kids rents a hotel room on Friday night and wants to host a smoke-out?

The Commission has you covered. Massachusetts’ regulations were specifically designed to limit access to a standard residence. The Commission defines Residence as “a house, condominium or apartment, and excludes, unless otherwise authorized by law, dormitories or other on-campus college or university housing; bed-and-breakfast establishments, hotels, motels or other commercial hospitality operations; and federal public housing [identified at https://resources.hud.gov/], shelters or residential programs.”

Orders, meanwhile, can only be handed off to the name listed on the manifest when the order was placed. If a wife makes an order but only the husband is home to receive it, the delivery will not be completed. If no one is home or the customer is not available, the order must be returned to the warehouse. Order deliveries cannot be diverted to another address or left in a “safe place” to be retrieved later (such as instructing the delivery agent to “open the side door to the garage and leave it on top of the recycle bin”).

Municipal Revenue and Community Impacts of Home Delivery Businesses

1—Who gets the sales tax?

Retail sales in the Commonwealth are recorded by the selling retailer who makes the final transfer of goods or services to a purchaser/consumer. When a restaurant sells a meal which is delivered by a food delivery service, the restaurant records the full amount of the sale and collects tax on the full balance. A Marijuana Retail Establishment collects a 20% tax when a sale is completed and three percent of that tax is paid to the local municipality that hosts the retail store.

A Marijuana Courier (the “UberEats”-type model) that delivers an order for a Marijuana Retail Establishment only records as revenue its delivery fee. A courier never takes ownership of the order (just as UberEats never “owns” the prepared food in your dinnertime order).

When a Marijuana Delivery Operator receives an online order, the order is fulfilled and delivered. The sale is a transaction of that specific Marijuana Delivery Operator. Therefore, if the municipality has elected the 3% local tax option, all local taxes collected by the Marijuana Delivery Operator accrue to the benefit of the host community. A host community that has banned retail marijuana stores can still opt to host a Marijuana Delivery Operator without having to allow brick and mortar stores, and will capture the local tax revenue for all sales from the facility, regardless of where the consumer lives.

2—Will offering delivery cannibalize brick and mortar stores?

Maybe, maybe not. In mid-August, the US Census Bureau reported that “Ecommerce sales in the second quarter of 2020 accounted for 16.1 percent of total sales,” and had increased by almost 32% compared with the first quarter of 2020. The handwriting on the wall was clear, COVID has changed buying habits, and more consumers are opting for home delivery. We would expect that behavior to easily translate to cannabis. Unlicensed sellers had already transitioned from selling joints on a street corner to using Instagram and creating web sites long ago, powered by unregulated home dropoffs.

Consumer adoption of the legal model will likely be robust and quick, and the CDA’s members will probably feel some squeeze on their bottom line. One could easily envision a scenario where home delivery captures 30% or more of the regulated adult-use marijuana market. Consider that at present, numerous unregulated home delivery operators service thousands of customers. The hope is that providing easy to use legal platforms will bring more of these consumers into the regulated (and taxed) adult-use market. However, all is not lost for an existing brick and mortar retailer as they can contract with a home delivery courier in order to offer their customers the full suite of shopping options, from in-store, to curbside, and now home delivery.

3—Is walk-in business allowed?

Walk-in business is not allowed at a Marijuana Delivery Operator. Only licensed agents of the company are permitted access to the work space.

4—How much traffic will this type of business generate?

A Marijuana Delivery Operator facility is not allowed to advertise its address or have walk-in consumer traffic, so there is limited additional foot or vehicle traffic to such a facility. Unlike a pizza delivery where only a few orders are in a delivery vehicle at a time and the vehicle is routinely returning to the store for a new order, a Home Delivery Operator functions differently. Many Home Delivery Operators will load approximately 24 to 32 orders into a vehicle, optimize the delivery route, and provide the delivery team with a map and order manifests. The vehicle and two-person delivery team can be on the road for up to ten hours at a time.

5—How much noise and odor will the facility generate?

There is minimal adverse impact to the host community or surrounding neighbors because a Marijuana Delivery Operator does not cultivate marijuana and only deals with products in consumer sealed packages. Basically, a Marijuana Delivery Operator’s facility should not generate any significant noise or odor.

6—What are the sources of municipal revenue?

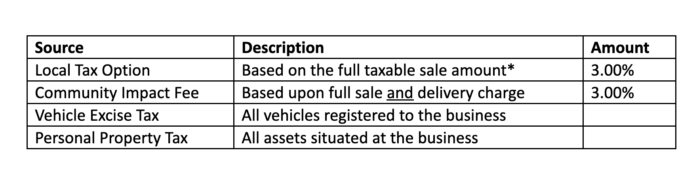

In addition to capturing 100% of the three (3%) percent local sales tax, percentage-of-revenue community impact fees (e.g. flat 3%) are based on the gross revenue amount (the full retail price plus any delivery fees). Marijuana Delivery Operators may become the largest revenue generator for a host community compared with other marijuana license classes. Vehicles will be registered as garaged in the host community, generating meaningful vehicle excise tax revenue.

Comments are closed